Hold your horses, crypto enthusiasts! Before you pour your hard-earned cash into Cryptogap (cryptogap.ltd), promising sky-high returns, let’s pump the brakes and investigate. This newcomer to the crypto investment scene might sound tempting, but can promises of lucrative returns translate to reality?

Join us as we unravel the mysteries behind Cryptogap, exploring its offerings and potential risks and, ultimately, helping you decide if this platform holds the key to your crypto fortune or if it’s best left unexplored.

What is Cryptogap about?

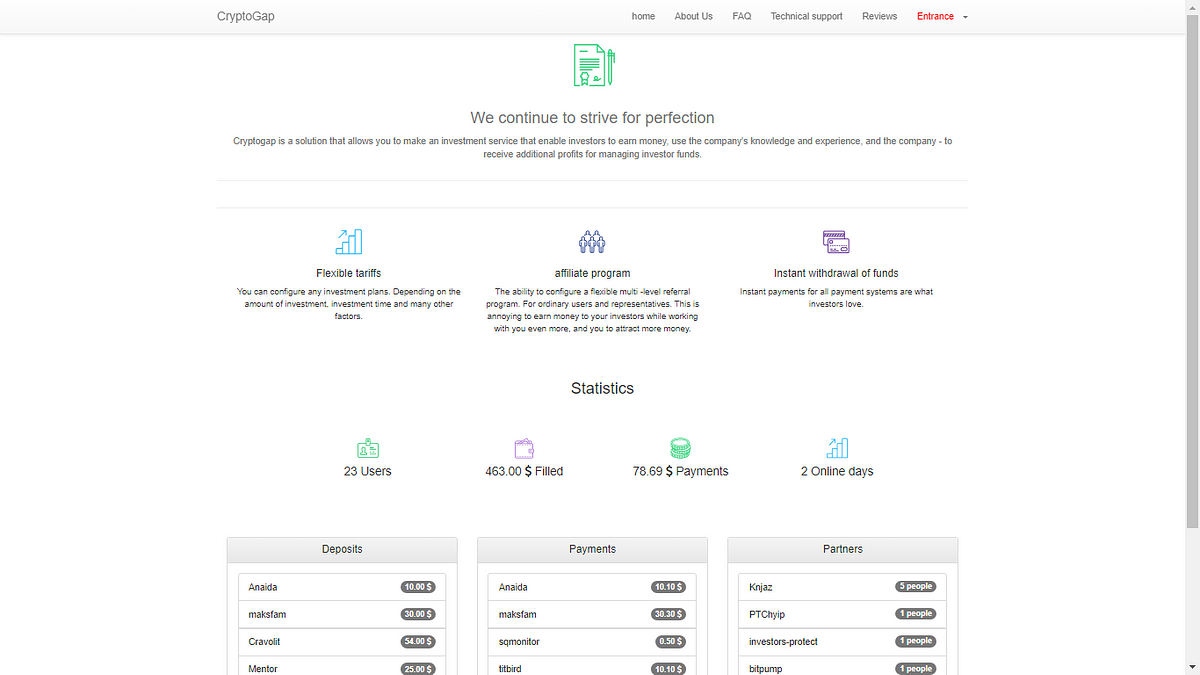

Cryptogap presents itself as a premier investment service provider within the cryptocurrency space, catering to investors seeking opportunities to generate passive income through the expertise of seasoned professionals. The platform’s core proposition revolves around leveraging the company’s extensive knowledge and experience in fund management to deliver lucrative returns for its clientele.

Moreover, it tries to portray itself as a platform that goes beyond mere financial transactions, aiming to foster long-term partnerships with its investors apparently through its commitment to transparency, reliability, and professionalism.

Cryptogap strives to build trust and confidence among its client base without concrete evidence of their expertise. Hence, potential investors are advised to approach such claims with caution.

Investment Plans

Plan 1:

- 101% After 1 Day

- Minimum Deposit: $10

- Return: 101% of the deposited amount

- Duration: 1 day

Plan 2:

- 115% After 3 Days

- Minimum Deposit: $10

- Return: 115% of the deposited amount

- Duration: 3 days

Plan 3:

- 130% After 7 Days

- Minimum Deposit: $10

- Return: 130% of the deposited amount

- Duration: 7 days

Plan 4:

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

- 150% After 14 Days

- Minimum Deposit: $10

- Return: 150% of the deposited amount

- Duration: 14 days

Plan 5:

- 200% After 30 Days

- Minimum Deposit: $10

- Return: 200% of the deposited amount

- Duration: 30 days

Cryptogap Red Flags

Lack of Regulation: Cryptogap operates without regulation from reputable authorities such as FSMA, FCA, CySec, or ASIC. The absence of regulatory oversight raises concerns about the platform’s legitimacy and the safety of investors’ funds.

Negative Reviews and Complaints: Numerous negative reviews and complaints have surfaced regarding Cryptogap. Investors have reported issues ranging from difficulties with withdrawals to suspicions of fraudulent activities. These negative experiences highlight potential risks associated with the platform.

Recent Creation: The website appears to be a relatively new entrant in the market, suggesting a lack of track record or credibility compared to established alternatives. Newly created platforms may lack the stability and reputation needed to inspire investor confidence.

Limited Popularity: Cryptogap has limited visibility and popularity among users. A low level of website traffic and user engagement could indicate a lack of trust or interest in the platform. This may raise questions about the platform’s legitimacy and reliability.

Unrealistic Promises: The platform’s promises of high returns within short periods raise suspicions of being too good to be true. Such promises often signal potential scams or Ponzi schemes designed to lure unsuspecting investors with unrealistic expectations.

Lack of Transparency: Cryptogap’s website lacks transparency regarding its team members and operational details. The use of stock images as staff members further diminishes the platform’s credibility and trustworthiness.

Suspected Scam Allegations: The company has been accused of engaging in fraudulent activities, including false claims, illegitimate rules, and practices aimed at defrauding investors. These allegations cast doubt on the platform’s legitimacy and credibility.

Unverified Investment Strategies: The platform does not provide sufficient information about its investment strategies, risk management practices, and asset allocation techniques. Without transparency in these areas, investors are left in the dark about how their funds are being managed.

High-pressure Sales Tactics: Some users may report being subjected to high-pressure sales tactics, such as continuous calls urging them to invest higher amounts. These tactics can be indicators of a potential scam, as legitimate investment platforms typically prioritize informed decision-making over aggressive sales tactics.

Obscure Ownership and Location: Cryptogap has not disclosed clear information about its ownership structure or physical location. Lack of transparency in these areas can make it difficult for investors to hold responsible parties accountable in case of disputes.

Inconsistent Operational Practices: The platform’s operational practices appear inconsistent or erratic, such as sudden changes in website URLs or the inability to contact customer support. These inconsistencies can raise suspicions about the platform’s reliability and may indicate underlying issues with its operations.

Is it Scam or Legit?

Let’s be honest: when it comes to investing in crypto, there are enough wild rides without hopping on a platform that feels like a rickety roller coaster in the dark. Now, I’m not here to say Cryptogap is definitely a scam, but let’s be real – the warning signs are stacked high.

Before you even think about handing over your hard-earned cash, do your research, double-check everything, and maybe even talk to a financial advisor you trust. However, the aforementioned concerns highlight the necessity for independent verification before entrusting one’s investments to this platform.

Remember, responsible investing prioritizes informed decision-making and minimizes unnecessary risks. While the potential for high returns may be enticing, safeguarding your financial well-being should always be the primary objective.

Verdict

Cryptogap might be whispering sweet nothings in your ear, promising a treasure trove of riches just beyond your fingertips, but the platform’s fresh-faced appearance raises eyebrows. It’s the new kid in town, and in the Wild West of crypto, newbies often lack the established trust and track record seasoned players boast.

Beyond superficial concerns, more ominous accusations cloud Cryptogap’s reputation. Allegations of fraudulent activity and high-pressure sales tactics necessitate closer scrutiny. While definitive judgments remain elusive, such charges cannot be easily dismissed. Hence caution and research are paramount before investing with Cryptogap.

If you have fallen victim to online scams, please comment below. If you have suffered a substantial financial loss, do not despair. We are here to assist you in recovering your funds!

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.