Freedom Debt Relief Scam or Not? >> Freedom’s debt experts assist clients throughout the debt settlement process by negotiating on their behalf with creditors. The Consumer Financial Protection Bureau (CFPB) sued the firm in 2017 on allegations of operating an unfinished debt-resolution business, pushing customers to negotiate settlements, and concealing the cost of services.

On July 1, 2019, Freedom agreed to pay $20 million in restitution to impacted consumers and a $5 million civil penalty to resolve the CFPB complaint.

Freedom Debt Relief Business Model

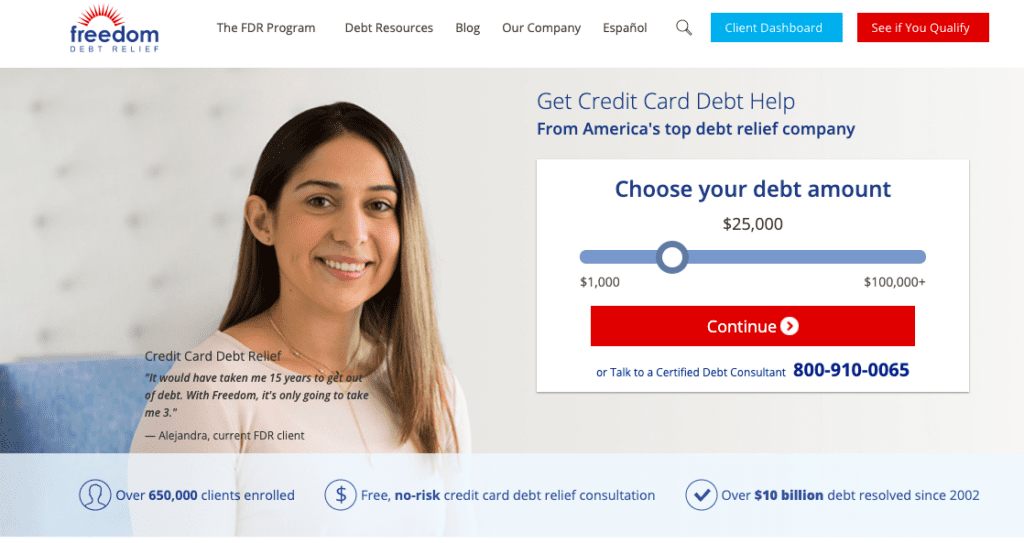

Freedom’s main aim for those who are in debt due to credit cards, medical expenses, personal loans, private school loans, and other forms of unsecured debt is to assist individuals in regaining control of their financial life. You must have a total debt of $7,500 to qualify. Enroll all credit cards with a balance of $500 or more.

While other debt relief businesses, such as Freedom, cannot assist customers who owe money secured by a mortgage or a car loan, they can assist customers who owe money secured by a mortgage or a vehicle loan. Additionally, it will have no effect on the federal student loan burden.

According to Sean Fox, co-president of Freedom, each new customer carries an average of $25,000 in unsecured debt, which is spread over eight credit cards. Some customers may have as many as twenty credit accounts, and Fox asserts that unsecured debt may vary from $7,500 to $100,000.

Any state that has implemented the Freedom Debt Relief policy has now lifted its prohibition on borrowers participating in the programme.

Freedom Debt Relief Process

In comparison to other debt settlement firms, freedom’s debt settlement procedure is very straightforward. When you join, your creditors lose access to your funds. Rather than that, you establish a separate savings account in which you may manage and track all of your contributions and deposit your monthly payments.

Each month, customers and Freedom agree on the amount of money to deposit into the savings account. Your capacity to pay and the overall amount of your debt both go into the charge calculation.

Contacting creditors to request a payment suspension may result in late fees, interest charges, and a potential decline in your credit score. For seven years, delinquent accounts will appear on your credit record.

Following the repayment of your debt, the firm will contact individual creditors to see if they can agree to a settlement that is less than what you owe. It is thought that if the creditor defaults for an extended length of time, they will ultimately be forced to accept a lesser payment in order to prevent losing everything.

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

Freedom Debt Relief Charges

After receiving permission from the creditor, you repay the debt by putting the payback amount into your savings account. This may be accomplished in a single payment or in several payments, depending on the terms of your arrangement with the creditor. Additionally, you must compensate Freedom Debt Relief for its help.

As a consequence, after all invoices are paid, Freedom is compensated once for each service provided. Charges for enrolling debt range between 18% and 25%. Fees vary by location.

The average consumer spends between $900 to get a $5,000 credit card debt reduced to $3,000.

According to Fox, the special-purpose account requires a one-time charge of $9.95 and a monthly fee of $9.95 to maintain.

Time Window

While the majority of clients will get their first payment within six months after entering the programme, some factors may cause this to take longer. If you save monthly, for example, the plan may take longer to complete since it must catch up with your funds.

Borrowers who pay their payments on time and put money into their savings accounts each month may fully repay their stated debt in two to five years, according to Freedom.

Risks

Late payments appear on credit records, and credit scores may worsen, making future credit more difficult to get. Bankruptcy procedures typically last seven years, which means that past-due accounts and those charged off by lenders will remain on your credit reports for that length of time.

There is no such thing as a guarantee of success. You may or may not be able to repay all of your debt, depending on your circumstances. Debt settlement firms cannot depend on some creditors for assistance, since they are more interested in selling the debt to a collection agency or a debt buyer. Due to the third-party component, Freedom warns that this tool may encourage customers to engage directly with creditors.

Additionally, it is said that people who attempt debt settlement programmes must commit to them for an extended period of time and pay at least two-thirds of their obligations before experiencing any advantages. The majority of clients complete the Freedom Programme within three years and ten months.

While you are through debt settlement, you will continue to accrue interest and late fees on your debt. When you have accumulated sufficient funds to make a fair offer to creditors, negotiations may not begin for months. If you do not finish the plan or if you and Freedom are unable to reach an agreement, you will be stuck with the larger amount.

Alternatives

- Create a debt management plan.

- Declaring bankruptcy

- Consolidating your debts is acceptable

When you declare bankruptcy, the courts in the United States will continue to protect you while enabling you to discharge your debts. Chapter 7 bankruptcy often takes more than three to six months to complete.

If you fall behind on your payments, collection agencies will not contact you and no legal action will be taken against you. While your credit will suffer, this same study indicates that credit scores usually recover within a year.

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.