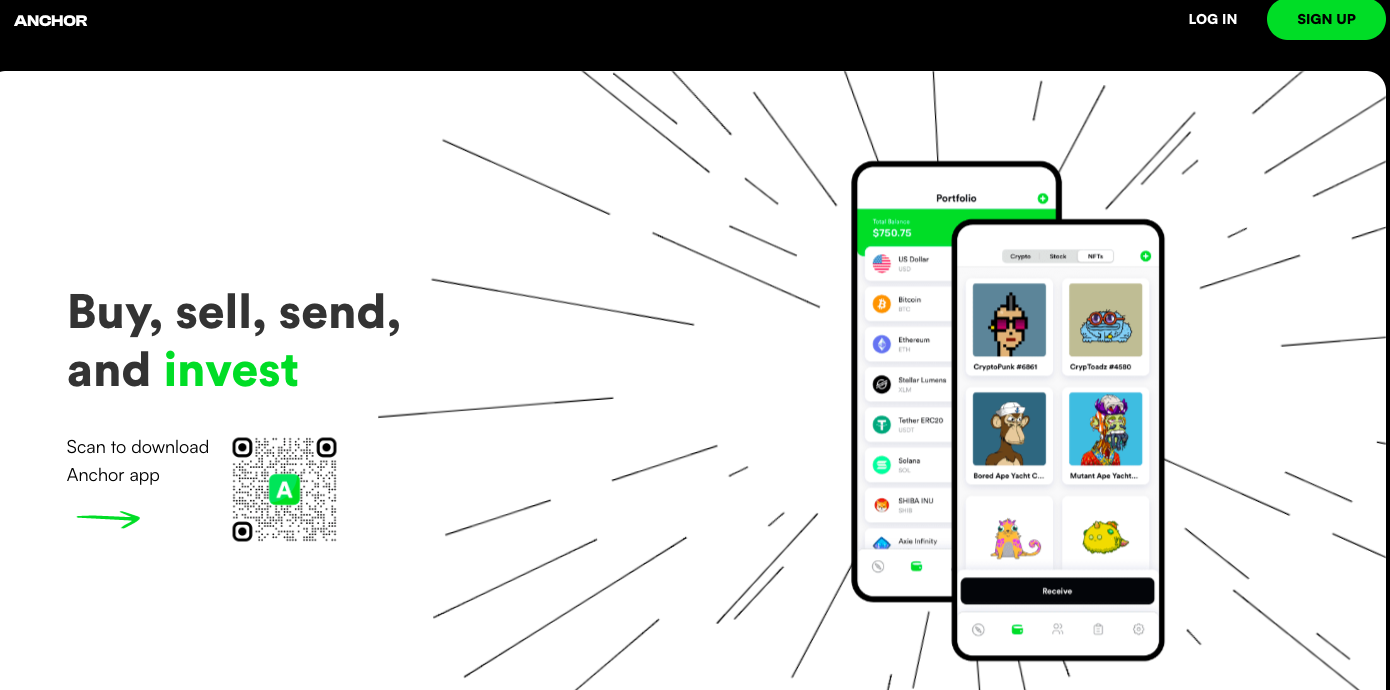

Anchor (Tryanchor.com) is an exchange/intermediary company that allows people to move funds from one bank account to another via cryptocurrencies. They also allow people to invest money in this space and offer fractional trading features as well.

Their website is minimalistic, but there is an unjustifiable lack of clarity about many aspects. For starters, there is no “About Us” section. Information regarding the management side is bleak at best. Also, few statements are bizarre.

At first glance, they do look professional. However, after analysing them thoroughly, we can confidently say that there are much better options available.

To know more about the things this platform has to offer, continue reading. If you have used their services before, share your opinion by commenting below.

Anchor Business Model

Anchor functions very similarly to a crypto exchange, the only exception is the bank account linking feature. The bank accounts synced with the platform are FDIC insured, but guess what? The crypto transactions will not receive the same treatment.

Due to lack of information, we cannot know their exact source of revenue. On the broader scale, the facilitation of funds from the bank account to any recipient via cryptocurrency is their unique selling point.

If we leave all the glitter from the narrative, they have not introduced any new concept or cutting edge applications. In short, the ambiguity is too much and as customers, it is indeed very hard to trust anything they say or imply.

Trading Feature

There are tons of options when it comes to crypto trading. For safety reasons, we always encourage our readers to stick with regulated options. Remember, offshore entities offer enticing deals, but it always comes with risk which is too much to bear for almost all of the retail side of the equation.

Anchor offers retail investors with trading opportunities. However, their spreads and conditions aren’t the most ideal fit for everyone. The fees are non-existent.

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

Nonetheless, there is nothing about them that makes them stand out in the crypto realm. Given the basic nature of the trading activities, we suggest you look elsewhere.

Anchor Security Measures

Anchor uses top of the class security measures which are explained in-depth below. Convenience factor is also not something to complain about.

Biometric and PIN authorization are becoming increasingly important and this platform has used a combination of both to provide utmost security. The use of biometrics such as fingerprints and facial recognition provides a level of security that traditional passwords and physical keys can’t match.

Since biometrics are unique to each person, the risk of unauthorized access is greatly reduced and they are difficult to duplicate or steal. This makes them a much more secure option compared to passwords that can easily be forgotten, lost, or stolen.

Another advantage of biometric and PIN authorization is convenience. With the quick and easy use of biometrics and PINs, users don’t have to remember complex passwords or carry separate authentication devices. This streamlines the authentication process and provides a better overall user experience.

Finally, biometric and PIN authorization also support multi-factor authentication. By combining biometrics with a PIN, organizations can add an extra layer of security that requires multiple forms of identification.

This makes it much more difficult for unauthorized users to access sensitive information as they would need both the biometric data and the correct PIN.

FDIC Insurance Importance

This firm talks a lot about FDIC insurance provided by bank accounts. However, they do not fall under the protection extended by the regulation. Their policies are also too mysterious. Just to make you realise the importance of FDIC insurance, we have created the following paragraph.

The FDIC, or Federal Deposit Insurance Corporation, is a helpful government agency that provides insurance for depositors’ savings. This insurance guarantees that if your bank fails, you won’t lose your hard-earned money. The FDIC currently insures depositors’ accounts up to $250,000 per bank.

This protection helps give depositors peace of mind, knowing their savings are safe and secure, even in the worst-case scenario. Having FDIC insurance helps build trust in the banking system, so you can feel confident your money is in good hands.

Is Anchor Scam or Legit?

Anchor is not a scam, but the platform itself is undeniably shady. From customer support to management, there is always mysteriousness surrounding them. They are unregulated and the risks posed by them are way too much for the average user.

Customer reviews and ratings also aren’t particularly reassuring. People have faced quite a number of issues with them. All in all, this platform isn’t something that we can trust and that’s the key takeaway.

Bottom Line

Cryptocurrency markets are becoming too volatile day by day. Trading and investing in this sector requires a lot of skill and knowledge. More importantly, finding a reliable entity to do your bidding is also a big step.

Do thorough research before choosing any investment platform and unless the firm you are looking at is regulated, it is better to stay away from them.

If you have fallen victim to online scams, please comment below. If you have suffered a substantial financial loss, do not despair. We are here to assist you in recovering your funds!

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.