In the fast-paced world of investment opportunities, High-Yield Investment Programs (HYIPs) have emerged as a tantalizing option for those seeking substantial returns in relatively short periods. Among these HYIPs stands Automind Company (automind.company), a platform that promises lucrative profits to investors. However, as the saying goes, “high reward often comes with high risk”

In an era of constantly evolving financial markets, HYIPs have garnered attention for their potential to generate significant returns. Yet, the allure of quick profits often obscures the underlying risks inherent in such ventures.

Against this backdrop, Automind Company emerges as a focal point of interest. The platform beckons investors with the prospect of financial growth by promising daily profits and flexible investment plans. However, beneath the veneer of promise lies a landscape fraught with uncertainties and potential pitfalls. By examining the facets in detail, we aim to empower investors with the knowledge and insights to make informed decisions in HYIP investments.

Join us as we navigate the complexities of Automind Company, unraveling its mysteries, weighing its merits and demerits, and ultimately, arriving at a verdict that seeks to guide investors on their quest for financial prosperity in an ever-changing investment landscape.

Automind Company Overview

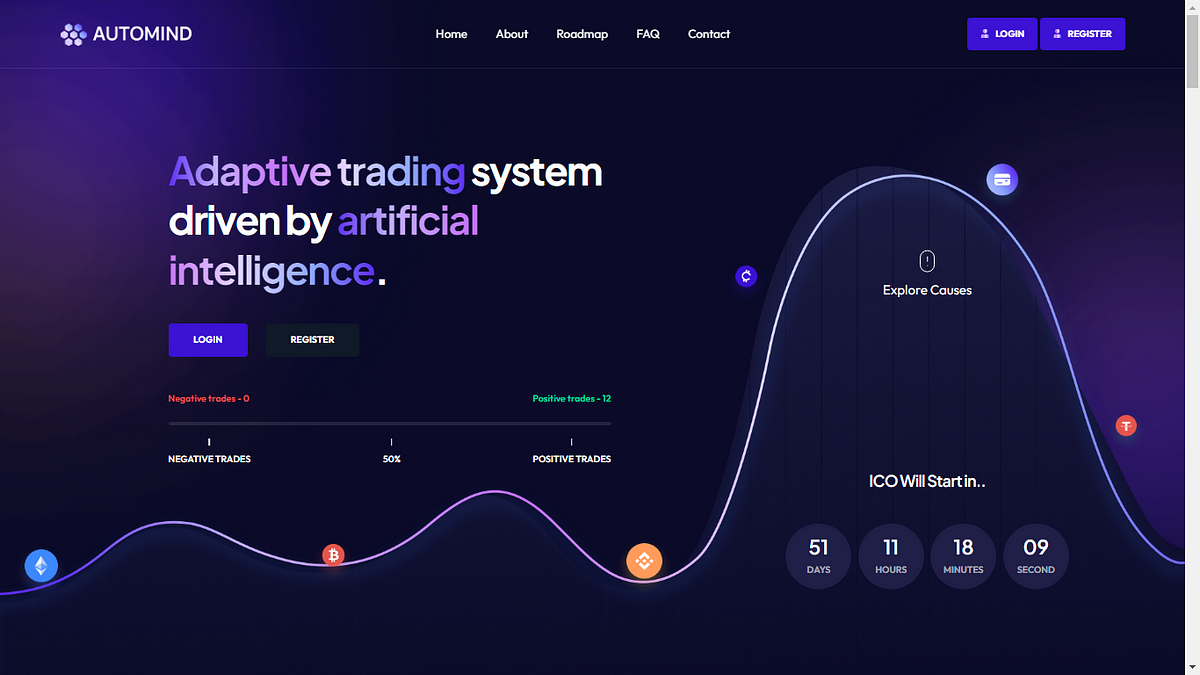

Automind Company is a dubious online platform masquerading as a legitimate High-Yield Investment Program (HYIP), but don’t be fooled by its promises of financial prosperity. With its flashy website and enticing claims, Automind Company lures unsuspecting investors into a web of deception.

Operating under the guise of offering daily profits, Automind Company preys on individuals seeking quick and easy returns. However, beneath its facade of wealth creation lies a cesspool of deceit and manipulation.

The investment plans touted by Automind Company are nothing more than smoke and mirrors designed to trap investors in a cycle of financial loss. Promising lucrative returns for minimal effort, these plans are engineered to siphon funds from unsuspecting victims with no intention of delivering on their empty promises.

Furthermore, Automind Company’s referral program serves as a tool for expanding its reach and ensnaring more victims. The platform perpetuates its fraudulent activities by incentivizing existing investors to recruit new prey, leaving a trail of shattered dreams and empty bank accounts.

But the deception doesn’t end there. Automind Company’s lack of transparency and regulatory oversight further compounds its nefarious intentions. With no verifiable information about its operations or management team, investors are left in the dark, vulnerable to exploitation by unscrupulous actors.

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

Investment Plans

Let’s delve into the abyss of Automind Company’s deceitful investment offerings:

- 2.5% Daily Profit for 40 Days: The flagship investment plan touted by Automind Company promises a daily profit of 2.5% for 40 days. Sounds enticing, doesn’t it? But don’t be fooled by the allure of daily profits. This plan is a sham, engineered to drain your funds and leave you high and dry.

- Minimum Deposit of $30: With a seemingly low barrier to entry, the company encourages investors to part with their hard-earned money with a minimum deposit requirement of just $30. But don’t be deceived by the modest amount. Once you take the plunge, you’ll find yourself ensnared in a web of financial deceit from which escape is impossible.

- Maximum Deposit of $500,000: For those willing to risk it all, Automind Company offers a maximum deposit cap of $500,000. But be warned: entrusting such a substantial sum to this fraudulent platform is akin to throwing your money into a bottomless pit, never to be seen again.

Referral Program

- 5% Direct Referral Commission: Automind Company dangles the carrot of a 5% commission for investors who successfully lure new victims into its clutches. This generous commission may seem like easy money, but it’s a ploy to incentivize existing investors to promote the platform to their unsuspecting acquaintances.

- 0.5% Indirect Referral Commission: But the deception doesn’t end there. It sweetens the deal by offering an additional 0.5% commission on indirect referrals. By rewarding investors for recruiting new victims, the platform creates a vicious cycle of exploitation, with each referral fueling its insidious agenda.

Automind Company Risks

- Operational Opacity: One of Automind Company’s primary risks is its operational opacity. The platform lacks transparency regarding its ownership, management team, and operational structure. Without clear information about the individuals behind the platform, investors are left vulnerable to fraudulent activities and exit scams.

- Regulatory Ambiguity: Automind Company operates within the grey area of regulation. HYIPs like Automind Company often skirt regulatory oversight, leaving investors unprotected in the event of fraudulent practices or sudden closures. The absence of regulatory scrutiny increases the likelihood of financial loss for investors.

- Unrealistic Profit Claims: Automind Company entices investors with the promise of daily profits, often ranging from 2% to 5% or more. However, these profit claims are often unrealistic and unsustainable.

- Ponzi Scheme Dynamics: HYIPs like Automind Company often exhibit characteristics of Ponzi schemes, where returns are paid to investors using the capital from subsequent investors rather than legitimate business activities. As the scheme grows, it becomes increasingly unsustainable, eventually collapsing and leaving most investors with significant losses.

- Lack of Track Record: The platform lacks a verifiable track record of successful investments or satisfied investors. Investors cannot assess the platform’s credibility or reliability without evidence of past performance or user testimonials.

- Security Concerns: Investing in this company exposes investors to potential security risks, including data breaches and hacking attacks. Without robust security measures, investors’ personal and financial information may be at risk of compromise.

Verdict

In the treacherous world of online investments, Automind Company stands as a beacon of deceit and deception. With its opaque operations, unrealistic profit claims, and dubious practices, this platform reeks of a classic Ponzi scheme in disguise.

Investors who dare to venture into the murky waters of Automind Company are likely to find themselves drowning in financial ruin. To safeguard your hard-earned money from the clutches of this fraudulent scheme, it’s imperative to steer clear of this website and explore more trustworthy investment avenues.

Remember, trust is a luxury you can’t afford to lose in the realm of online investments.

If you have fallen victim to online scams, please comment below. If you have suffered a substantial financial loss, do not despair. We are here to assist you in recovering your funds!

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.