IC Markets, headquartered in Sydney, Australia, is a well-known and established internet trading business. The business, which was established in 2007, is owned and operated by International Capital Markets PTY. It is headquartered at Level 6, 309 Kent Street, Sydney, New South Wales 2000.

The online broker is well-known in Australia, and it is often regarded as the finest online brokerage accessible, because of its high leverage, low spreads and costs, and other benefits.

By providing investment options that were previously exclusively available to investment banks and high-net-worth people, the trading firm hopes to bridge the divide between regular customers and large institutional investors.

IC Markets is a forex broker that specialises in currency trading, but it also provides futures, indices, and commodities to its clients.

IC Markets Regulation and History

The Australian Securities and Investments Commission licenced and regulated the IC Markets brokerage in 2009 under licence number 335692.

The company is well-known as one of the most trustworthy online trading brokers available. ASIC is a well-known and rigorous regulatory body that requires the platform to comply with severe rules and processes.

Apart from being regulated by ASIC, the brokerage is a member of the Financial Ombudsman Service (FOS). Customers of IC Markets may utilise this service to quickly and professionally address any problems they may have.

This provides an additional layer of security and customer satisfaction for companies by ensuring that they will be covered in the event of an incident.

Apart from IC Markets, the company operates two more regulated brands:

In the Seychelles, IC Markets are regulated by the Financial Services Authority (FSA).

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

CySec regulates IC markets in the European Union.

IC Markets Trading Platforms

At IC Markets, MetaTrader 4 is the most popular trading platform. The MetaTrader 4 software enables traders to execute trades with a single click and also includes customizations for market depth research.

The platform includes a comprehensive set of technical indicators, sophisticated charting tools, a large number of Expert Advisers, and significant back-testing capabilities.

Traders may also trade on the move by downloading the MetaTrader4 mobile applications for Android and Apple, or by accessing the MetaTrader platform through the web from any PC.

MetaTrader 5 is essentially an improved and extended version of MetaTrader 4.

This trading platform was created with ECN trading in mind. This category covers trading software accessible through mobile devices, desktop computers, and the internet.

Traders interested in using auto-trading may do so via ZuluTrade, Myfxbook’s AutoTrade, or Signal Trader’s mirroring technology.

Account Types

IC Markets offers three distinct account kinds, each of which is designed to meet the specific requirements of each trader. Traders may open one of three types of accounts: “Standard,” “True ECN,” or “cTrader ECN.” While the tales vary considerably, they all have some common characteristics.

While all accounts have very low spreads, the True ECN account has significantly lower spreads. Additionally, traders may practise trading utilising IC Markets’ live demo account.

The trader may practise utilising virtual money in a real-world market environment with this account.

Asset Class

When it comes to providing its customers with a diverse array of trading instruments and assets, the IC Markets trading brokerage does not disappoint. The brokerage offers currency pairings, CFDs on indices, equities, commodities and futures, precious metals, and even famous cryptocurrencies like Bitcoin and Ethereum.

Forex trading accounts for a significant part of IC Markets’ offerings. Currency pairings comprise the lion’s share of the 90+ trading assets offered. This is backed up with up to 500:1 leverage and lot sizes as small as 0.01.

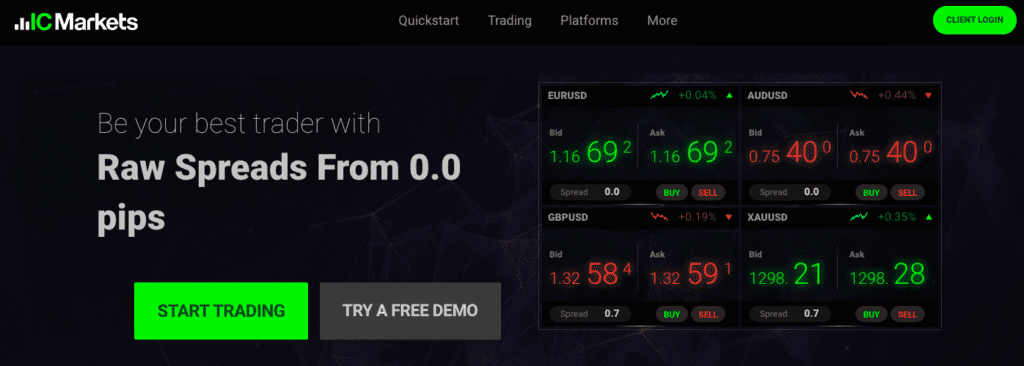

Spreads

Spreads on the cTrader platform may be lowered to 0.0, saving regular traders money on commissions and spreads. Spreads are very tight on average, with EUR/USD spreads as low as 0.1 pip. This has a significant impact on day trading profit margins.

IC Markets Funding and Payments

IC Markets provides a wide range of deposit alternatives in 10 different currencies to its clients. Among them are the AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF. Credit and debit cards, bank wire transfers, broker-to-broker transfers, branch cash deposits, BPay deposits, PayPal, Skrill, Neteller, WebMoney, QIWI, China Union Pay, and FasaPay are all accepted as methods of deposit.

The majority of these deposit options are instant and accept a number of different currencies.

Withdrawals may be done in many of the same ways that deposits are made. Domestic bank transfers and e-wallet withdrawals are complementary and may be completed on the same business day. Withdrawals from non-Australian countries may take up to 3-5 business days and are subject to a fee of $25 AUD.

Customer Service

IC Markets is unmatched in terms of customer service. Customers may contact them in many languages through live chat, email, or their worldwide phone support hotline. Five days a week, twenty-four hours a day. Additionally, there is an excellent help centre where customers may get solutions to the majority of their problems.

Bottom line

IC Markets is a really outstanding forex trading platform.

It provides competitive currency rates and the process of establishing an account is simple and quick. Deposits and withdrawals are both free, and the system is very user-friendly. Additionally, the website’s education part is beneficial.

On the other hand, IC Markets trades solely FX and CFDs. Additionally, live chat assistance should be improved, and customers outside the European Union are not protected by any investment protection programme.

Traders from the United States of America, Canada, Zimbabwe, Iran, Iraq, Ghana, Côte d’Ivoire, Cuba, Liberia, Niger, and Togo are not permitted to trade on IC Markets.

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.