IronFX is a forex trading platform that allows you to trade currency pairs, contracts for difference, commodities, indices, futures, stocks, and gold, silver, and oil. The broker first opened its doors in 2010. IronFX is owned by Notesco Ltd, a Bermuda-based company.

IronFX now serves over 1.2 million customers in 180 countries and offers more than 300 trading products across six asset classes. IronFX offers 24-hour, seven-day-a-week customer support in 45 different languages, as well as an online chat option.

This broker provides an Electronic Communications Network (ECN) via which customers may trade a number of markets, as well as a social trading technology called AutoTrade. IronFX is ideal for novices, since their website has a substantial part dedicated to trader education.

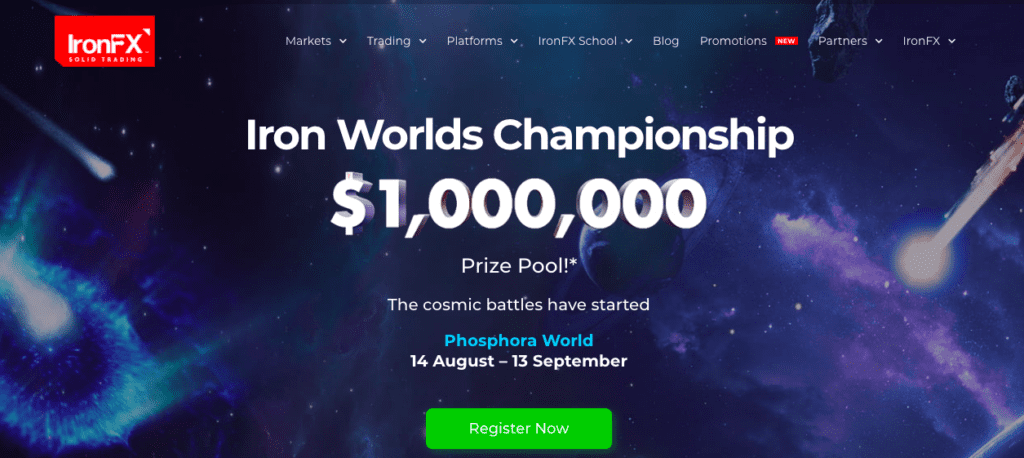

There are a number of incentives to new customers, including a live trading competition and several deposit bonuses.

Asset Class

IronFX is more than enough if your primary objective is to trade forex and CFDs on metals and other assets. IronFX does not provide trading in cryptocurrencies, real stock shares, stock options, or bonds if you have more expertise and trade in other major global marketplaces. IronFX enables the trading of the following asset classes:

- Forex

- Metals

- Indices

- Commodities

- Futures

- Shares

Customer Support

To contact customer care, you may use the IronFX website’s live chat function. Additionally, the broker offers email and phone assistance in 45 languages 24 hours a day, seven days a week throughout the trading week.

IronFX Trading Interface and Tools

IronFX is generally regarded as one of the market’s most flexible Forex trading systems. This is due to the fact that there are many trading platforms accessible.

They provide their own Web Trader platform, the industry-standard Meta Trader 4, a Personal Many Account Manager, and a terminal system for individuals who want to handle multiple trading accounts from a single screen. Additionally, it’s worth noting that IronFX offers mobile-friendly services.

Many individuals will pick Meta Trader 4 due to its clarity and intelligence. This system is user-friendly, quick to process orders, and includes online news, charts, and activity reports.

On the other side, IronFX’s proprietary WebTrader software package provides a robust alternative. It’s worth noting that the WebTrader is entirely browser-based, which eliminates the need to download it.

Get in touch with our affiliated Cryptocurrency Forensic Specialists at CNC Intelligence for free by filling out the form below.

Finally, their trading app for smartphones is an exact replica of the WebTrader computer system. It’s worth noting that the effectiveness of any of these platforms is contingent upon the quantity of available system RAM and the speed of the Internet connection.

IronFX Leverage and Trading Conditions

Any Forex trader knows the value of leverage. It is critical to note that excessive leverage carries a significant financial risk and should be performed only by those with extensive business expertise.

Another significant advantage for individuals wishing to evaluate IronFX prior to making a purchase is the availability of a free demo account. In contrast to some of its rivals, this account is revocable and includes access to all trading platforms. This enables a beginner to make an informed choice about which system is best for him or her.

Account Types

At IronFX, customers may choose from four distinct accounts. These are known as:

- ECN

- Premium

- VIP

- Micro

To open an ECN account, a minimum deposit of $500 is needed. Spreads are variable, averaging 1.7 pips. A position may be as little as 0.1 lot in size.

Their Premium edition requires a one-time payment of $2,500. Spreads are fixed, but have been reduced to 0.7 pips (worth noting).

VIP accounts cost $20,000 or more. Spreads have been further reduced to 0.2 pips and re-set. Thus, the main distinction between Premium and VIP accounts is the spread level.

IronFX Regulation

IronFX, founded in 2010, is a well-known online Forex trading platform. The firm’s first major advantage is that it has more than 60 offices worldwide and is fluent in at least 45 languages.

IronFX is also regulated by the Financial Conduct Authority (UK), the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the FSP regulatory authorities (New Zealand)

IronFX is a full member of the Eurex exchange and operates in accordance with MiFID regulations.

Verdict

IronFX specialises in forex and CFD trading across a broad variety of assets. While IronFX may be appropriate for traders seeking to trade only in these markets, the absence of stock and option trading outside of share CFDs may frustrate stock and option traders. If you want to trade a broader variety of asset classes, you should seek out another online broker.

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.